Veterans Housing Programs 2026: VA Loans & 0% Down Options

Veterans Housing Programs 2026 provide essential financial assistance and housing solutions, primarily through VA Loans offering 0% down payment options and various supportive housing initiatives, to help eligible service members and their families achieve homeownership and stable living.

Securing a stable and affordable home is a cornerstone of well-being, especially for those who have dedicated their lives to serving our nation. In 2026, understanding the nuances of Veterans Housing Programs 2026: Securing VA Loans and Supportive Housing with 0% Down Payment Options is more crucial than ever for veterans and their families navigating the complex housing market. These programs are designed not just to provide financial aid, but to empower veterans with the resources needed to achieve sustainable homeownership and access vital supportive housing.

Understanding VA Loans: Your Path to 0% Down Payment Homeownership

VA Loans stand as one of the most significant benefits available to eligible service members, veterans, and surviving spouses, offering a unique opportunity for homeownership without the burden of a down payment. This program is not administered by the Department of Veterans Affairs directly as a lender, but rather guarantees a portion of the loan, allowing private lenders to offer more favorable terms.

The primary appeal of a VA Loan is its 0% down payment option, which significantly lowers the financial barrier to entry for many veterans. Unlike conventional mortgages that often require substantial upfront cash, VA Loans eliminate this hurdle, making homeownership a more attainable dream. This benefit not only saves veterans money at closing but also frees up their savings for other essential expenses related to moving or home improvements.

Eligibility Requirements for VA Loans

To qualify for a VA Loan, veterans must meet specific service requirements established by the VA. These generally include:

- Serving 90 consecutive days of active service during wartime.

- Serving 181 days of active service during peacetime.

- Serving more than 6 years in the National Guard or Reserves.

- Being the spouse of a service member who died in the line of duty or as a result of a service-related disability.

Beyond service, veterans must also obtain a Certificate of Eligibility (COE) from the VA, which confirms their eligibility for the benefit. This document is a critical step in the VA loan application process and verifies that the veteran has met the necessary service criteria.

Benefits Beyond Zero Down Payment

While the 0% down payment is a major draw, VA Loans offer several other compelling advantages. These include competitive interest rates, often lower than conventional loans, due to the VA guarantee. Furthermore, there is no requirement for private mortgage insurance (PMI), which can save borrowers hundreds of dollars each month compared to other loan types.

The VA also sets limits on closing costs, ensuring that veterans are not overcharged during the home-buying process. Additionally, the VA provides assistance to veterans struggling to make their mortgage payments, helping them avoid foreclosure. This comprehensive support system makes VA Loans an invaluable resource for securing a home.

In essence, VA Loans are more than just a financing option; they are a testament to the nation’s commitment to those who served, offering a robust and supportive pathway to homeownership with unparalleled benefits tailored to the veteran community.

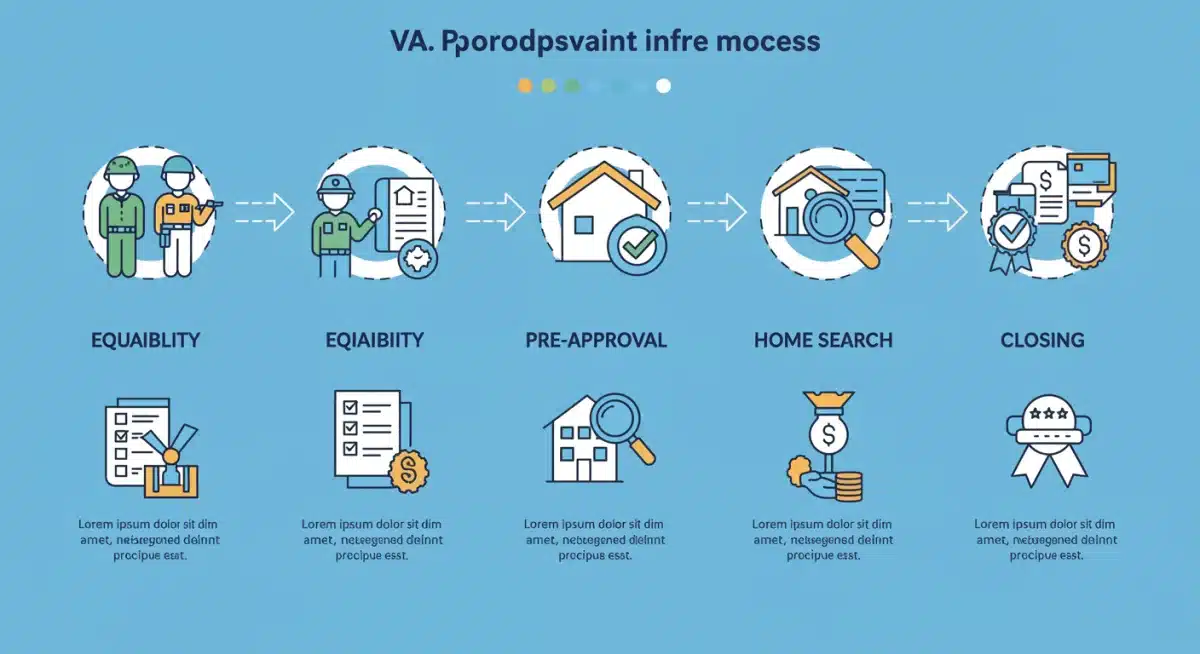

Navigating the VA Loan Application Process in 2026

The process of applying for a VA Loan can seem daunting at first glance, but with the right guidance and understanding of the steps involved, it becomes a streamlined journey. In 2026, the application procedures remain largely consistent, focusing on verification of eligibility and financial stability.

The initial step involves obtaining your Certificate of Eligibility (COE). This can be done online through the VA’s eBenefits portal, by mail, or through a VA-approved lender who can assist with the process. The COE confirms your military service meets the requirements for a VA loan.

Finding a VA-Approved Lender

Once you have your COE, the next crucial step is to connect with a lender who specializes in VA Loans. Not all lenders offer VA-guaranteed mortgages, so it’s essential to find one with experience and expertise in this specific product. An experienced VA lender can provide personalized advice, help you understand the nuances of the loan, and guide you through the underwriting process efficiently.

It is advisable to shop around and compare offers from several VA-approved lenders. While the VA sets guidelines, interest rates and fees can vary between institutions. Comparing loan estimates will ensure you secure the most favorable terms for your financial situation.

Understanding the Underwriting and Appraisal Process

After finding a suitable lender and submitting your application, the loan moves into underwriting. This phase involves a thorough review of your financial history, including income, credit score, and debt-to-income ratio, to assess your ability to repay the loan. While VA Loans are more flexible with credit scores than conventional loans, a healthy financial profile will always facilitate a smoother process.

A VA appraisal is also a mandatory part of the process. Unlike a standard home appraisal, a VA appraisal not only determines the home’s market value but also ensures it meets the VA’s Minimum Property Requirements (MPRs). These requirements are designed to ensure the home is safe, sanitary, and structurally sound, protecting both the veteran and the VA.

Successfully navigating the VA loan application process requires attention to detail and proactive engagement with your lender. By understanding each stage, veterans can confidently move towards securing their home with the benefits they’ve earned.

Supportive Housing Initiatives for Veterans in 2026

Beyond traditional homeownership through VA Loans, a critical component of Veterans Housing Programs 2026 involves various supportive housing initiatives. These programs are tailored to assist veterans who may be experiencing homelessness, facing housing insecurity, or requiring additional support services to maintain stable living situations.

The Department of Veterans Affairs (VA) works collaboratively with federal, state, and local agencies, as well as non-profit organizations, to provide a continuum of care. This includes emergency shelters, transitional housing, and permanent supportive housing, all designed with the unique needs of veterans in mind.

Homelessness Prevention and Rapid Re-Housing

One significant initiative is the Supportive Services for Veteran Families (SSVF) program. SSVF provides comprehensive case management and temporary financial assistance to very low-income veteran families who are homeless or at risk of becoming homeless. This can include help with rent, utilities, security deposits, and moving costs.

The goal of SSVF is to prevent homelessness and rapidly re-house veterans, ensuring they have a safe and stable place to live while also connecting them to other essential services like healthcare, employment assistance, and mental health support. This holistic approach addresses the root causes of housing instability.

Permanent Supportive Housing Programs

For veterans with chronic homelessness or disabilities, permanent supportive housing programs are vital. The HUD-VASH program (Housing and Urban Development-Veterans Affairs Supportive Housing) combines HUD’s Housing Choice Voucher (Section 8) rental assistance with VA case management and supportive services.

HUD-VASH helps veterans and their families find and maintain permanent housing, while also providing access to healthcare, mental health treatment, and substance use counseling through the VA. This integrated approach is crucial for veterans who require ongoing support to live independently and thrive in their communities.

These supportive housing initiatives underscore a broader commitment to ensuring that all veterans have access to safe, affordable, and stable housing, recognizing the diverse challenges many face after their service.

Special Considerations for Veterans with Disabilities

Veterans with service-connected disabilities often face additional challenges in securing suitable housing. Recognizing these unique needs, Veterans Housing Programs 2026 include specialized grants and adaptations designed to make homes more accessible and livable. These programs aim to enhance the quality of life for disabled veterans by providing financial assistance for necessary home modifications.

The VA offers several grants to help seriously disabled veterans purchase, construct, or modify a home to meet their specific needs. These grants are not loans and do not require repayment, making them an invaluable resource for eligible veterans.

Specially Adapted Housing (SAH) Grant

The SAH grant helps veterans with certain severe service-connected disabilities purchase or construct a specially adapted home, or to modify an existing home to make it suitable. This grant can be used to create a barrier-free living environment, including features like wheelchair ramps, widened doorways, and accessible bathrooms.

Eligibility for the SAH grant is determined by the nature and severity of the veteran’s service-connected disability. The grant can significantly reduce the financial burden of making essential home modifications, allowing veterans to live more independently and comfortably in their own homes.

Special Housing Adaptation (SHA) Grant

Similar to the SAH grant, the SHA grant assists veterans with certain service-connected disabilities in adapting an existing home or purchasing a home that has already been adapted. This grant is typically for less extensive adaptations compared to the SAH grant but still provides substantial financial aid.

The SHA grant can be used for modifications such as installing ramps, widening doors, or adapting kitchens and bathrooms to accommodate a disability. Both SAH and SHA grants are crucial for ensuring that veterans with disabilities have homes that are safe, accessible, and promote their independence and well-being.

These specialized grants highlight the VA’s commitment to supporting disabled veterans, ensuring their homes are not just places to live, but spaces that truly meet their adaptive needs.

Beyond VA Loans: Additional Housing Resources for Veterans

While VA Loans are a cornerstone, Veterans Housing Programs 2026 encompass a broader array of resources designed to support veterans at various stages of their housing journey. These resources extend beyond purchase financing to include rental assistance, home repair, and financial counseling, addressing a wide spectrum of needs within the veteran community.

Many non-profit organizations and government agencies partner with the VA to offer supplementary programs. These partnerships are vital in creating a comprehensive support network that catches veterans who might not fully qualify for VA loans or who need different types of housing assistance.

Rental Assistance Programs

For veterans who are not ready or able to purchase a home, rental assistance programs provide critical support. Beyond HUD-VASH, which combines housing vouchers with VA services, other local and state programs may offer rental subsidies or emergency rental assistance. These programs are often designed to prevent homelessness and ensure veterans have access to safe and affordable rental units.

Organizations like the National Coalition for Homeless Veterans (NCHV) and various local veteran service organizations (VSOs) often have information on available rental assistance and can help veterans navigate eligibility requirements and application processes.

Home Repair and Improvement Programs

- Home Depot Foundation: Partners with non-profits to repair and modify homes for veterans, often focusing on critical repairs and accessibility improvements for disabled veterans.

- Rebuilding Together: Provides free home repairs and modifications for low-income homeowners, including veterans, to ensure safe and healthy living conditions.

- Local Community Development Block Grants (CDBG): Many cities and counties use CDBG funds to offer home repair assistance programs that veterans may qualify for, especially if they meet low-to-moderate income criteria.

These programs are essential for maintaining the safety and habitability of veterans’ homes, preventing deterioration that could lead to more significant housing issues down the line. They also help veterans age in place comfortably and safely.

The diverse range of additional housing resources ensures that veterans have multiple avenues for support, reinforcing the commitment to their housing security and overall well-being.

Future Outlook: Enhancements to Veterans Housing Programs in 2026 and Beyond

As we look towards 2026 and the years that follow, the landscape of veterans housing programs is continually evolving, with ongoing efforts to enhance accessibility, expand benefits, and address emerging needs. Legislative changes, technological advancements, and a deeper understanding of veterans’ challenges are driving these improvements.

One area of focus is streamlining the application processes for VA Loans and other housing benefits. The VA is consistently working on digital platforms and partnerships to make it easier for veterans to access information, apply for benefits, and track their applications.

Potential Legislative Changes and Program Expansions

There is continuous advocacy for legislative changes that could further expand VA loan eligibility, increase loan limits in high-cost areas, or introduce new grant programs for specific veteran populations. For instance, discussions often revolve around extending benefits to more National Guard and Reserve members, or providing more robust support for aging veterans.

Furthermore, programs addressing rural veteran homelessness and housing in underserved areas are likely to see increased funding and innovative solutions. The aim is to ensure that geographical location does not become a barrier to accessing essential housing services.

Focus on Sustainable and Energy-Efficient Housing

Another emerging trend is the integration of sustainable and energy-efficient housing options into veteran programs. As environmental consciousness grows, there’s a push to educate veterans about energy-efficient upgrades that can lower utility costs and improve home comfort. Some programs may begin to offer incentives or specific loan products for green home improvements.

This focus not only benefits the environment but also provides long-term financial savings for veteran homeowners, contributing to their overall financial stability and reducing the cost of living.

The future of veterans housing programs is bright, with a clear direction towards more inclusive, efficient, and comprehensive support systems. These ongoing developments underscore a national commitment to honoring veterans by providing them with the stable and dignified housing they deserve.

Common Misconceptions About VA Housing Benefits

Despite the extensive benefits offered by Veterans Housing Programs 2026, several common misconceptions often prevent eligible veterans from utilizing these crucial resources. Clarifying these misunderstandings is vital for ensuring that more service members and their families can access the housing support they’ve earned.

One prevalent myth is that VA Loans are only for first-time homebuyers. This is incorrect; VA loan benefits can be used multiple times throughout a veteran’s life, provided they have remaining entitlement. Veterans can even have two VA loans simultaneously under certain circumstances.

Myth: VA Loans Require Perfect Credit

Many veterans believe they need a pristine credit score to qualify for a VA Loan. While a good credit score is always beneficial, VA Loans typically have more flexible credit requirements compared to conventional mortgages. The VA does not set a minimum credit score, though individual lenders will have their own criteria, often accepting scores lower than those required for other loan types.

The emphasis is often placed on overall financial stability, including consistent income and a manageable debt-to-income ratio, rather than solely on a credit score. This flexibility makes homeownership accessible to a broader range of veterans.

Myth: VA Loans are Only for Single-Family Homes

- Condominiums: VA Loans can be used to purchase condominiums, provided the complex is approved by the VA.

- Multi-Unit Properties: Veterans can use a VA Loan to purchase a multi-unit property (up to four units) if they intend to occupy one of the units as their primary residence.

- Manufactured Homes: In some cases, VA Loans can finance manufactured homes, though specific requirements apply regarding the foundation and permanent attachment to the land.

This versatility allows veterans to choose housing options that best suit their lifestyle and financial goals, whether it’s a traditional house, a condo, or a multi-unit investment property.

Dispelling these myths is crucial for empowering veterans to explore and fully leverage the comprehensive housing benefits available to them, ensuring they do not miss out on opportunities due to misinformation.

| Key Program | Brief Description |

|---|---|

| VA Loans | Guaranteed loans for eligible veterans, offering 0% down payment, no PMI, and competitive rates for home purchases. |

| Supportive Services for Veteran Families (SSVF) | Provides financial aid and case management to prevent homelessness and rapidly re-house very low-income veteran families. |

| HUD-VASH | Combines HUD rental assistance with VA supportive services for homeless veterans, promoting stable housing and well-being. |

| Specially Adapted Housing (SAH) Grant | Grants for severely disabled veterans to buy, build, or modify homes for accessibility, ensuring a barrier-free living environment. |

Frequently Asked Questions About Veterans Housing

Eligibility for a VA Loan generally includes active-duty service members, veterans, and certain surviving spouses who meet specific service length requirements. These vary based on when and how long the veteran served, as documented by a Certificate of Eligibility (COE) from the VA.

Yes, veterans can use their VA Loan benefit multiple times throughout their lives. The benefit is not a one-time use. As long as you have remaining entitlement, you can apply for another VA Loan. This flexibility allows veterans to adapt to changing housing needs.

The VA Funding Fee is a one-time payment required on VA Loans, which helps offset the cost to taxpayers. It varies based on factors like loan type, service type, and whether it’s a first-time use. Certain veterans, such as those receiving VA disability compensation, are exempt from paying this fee.

No, VA Loans are not just for single-family homes. They can be used for condominiums in VA-approved projects, multi-unit properties (up to four units if the veteran occupies one), and in some cases, manufactured homes. This provides versatility in housing choices for veterans.

The VA provides assistance to veterans facing difficulties with their VA-guaranteed mortgage payments. They can intervene on your behalf with the lender to explore options like repayment plans, loan modifications, or forbearance, helping veterans avoid foreclosure and maintain their homeownership.

Conclusion

The comprehensive network of Veterans Housing Programs 2026: Securing VA Loans and Supportive Housing with 0% Down Payment Options represents a vital commitment to those who have served our nation. From the unparalleled benefits of VA Loans, which open the door to homeownership without a down payment, to the critical supportive housing initiatives addressing homelessness and disability, these programs are designed to ensure veterans and their families have access to stable, safe, and affordable living. Understanding and utilizing these resources is paramount for veterans seeking to build a secure future, reflecting the nation’s ongoing gratitude and support for their invaluable contributions.