Life Insurance: Calculate How Much Coverage You Really Need

Determining the right amount of life insurance involves assessing your financial obligations, future needs, and current assets to ensure your loved ones are protected in the event of your passing. This step-by-step guide provides a comprehensive approach to calculating your coverage needs.

Navigating the world of **life insurance: How Much Do You Need? A Step-by-Step Guide to Calculating Your Coverage** can feel overwhelming. Many people wonder if they have enough coverage, too little, or even too much. This guide simplifies the process, providing a clear, actionable plan to determine the optimal life insurance amount for your unique circumstances.

Understanding the Basics of Life Insurance

Life insurance provides a financial safety net for your loved ones, replacing your income and covering expenses if you pass away. Understanding the core principles of life insurance is crucial before diving into calculating how much you need.

Life insurance isn’t merely about death; it’s about ensuring your family’s financial well-being continues even in your absence.

Types of Life Insurance

There are two primary types of life insurance: term life and permanent life insurance. Each serves different needs and comes with varying costs.

- Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years). It’s generally more affordable and suitable for covering temporary needs like mortgage payments or child-rearing expenses.

- Permanent Life Insurance: Offers lifelong coverage and includes a cash value component that grows over time. It’s more expensive but can serve as a financial asset and provide a death benefit.

- Whole Life Insurance: A type of permanent life insurance with a fixed premium and guaranteed cash value growth.

- Universal Life Insurance: Another form of permanent coverage offering flexible premiums and a cash value component tied to market performance.

Choosing between term and permanent life insurance depends on your financial goals, risk tolerance, and budget.

Consider your long-term financial objectives and how life insurance fits into your overall financial plan.

Step 1: Assess Your Current Financial Situation

Before calculating how much life insurance you need, it’s essential to evaluate your existing financial landscape. This includes understanding your income, debts, assets, and ongoing expenses.

A clear picture of your current financial standing will help you determine the appropriate level of coverage.

Calculate Your Net Worth

Start by calculating your net worth. This is the difference between your assets (what you own) and your liabilities (what you owe).

- Assets: Include savings, investments, real estate, and other valuables.

- Liabilities: Encompass debts like mortgages, student loans, credit card balances, and other outstanding obligations.

Understanding your net worth provides a baseline for assessing your overall financial health.

Knowing your key debts, assets, and expenses will help you calculate the right amount of coverage.

Step 2: Determine Your Family’s Immediate Financial Needs

Consider your family’s immediate financial needs if you were no longer around to provide support. These needs typically include funeral expenses, outstanding debts, and immediate living costs.

Addressing these immediate financial obligations ensures your family is taken care of during a difficult time.

Funeral Expenses

Funeral costs can be significant, often ranging from $7,000 to $10,000. Including this in your life insurance calculation can ease the burden on your loved ones.

Planning for funeral expenses helps prevent unnecessary financial stress during a period of grief.

Outstanding Debts

Identify any outstanding debts that your family would need to cover, such as mortgages, car loans, and credit card balances. Life insurance can help pay off these debts, relieving your family of financial strain.

Calculating debt coverage ensures your family isn’t burdened with significant liabilities.

Step 3: Estimate Future Living Expenses

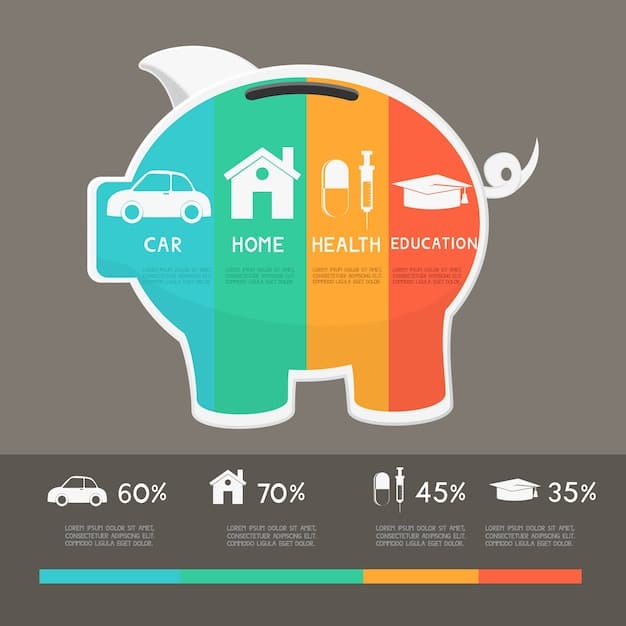

Project your family’s future living expenses, including housing, food, education, healthcare, and other essential costs. This step is crucial for ensuring your loved ones can maintain their standard of living.

Forecasting future living expenses helps provide long-term financial security.

Consider Inflation

Account for inflation when estimating future costs. Inflation erodes the purchasing power of money over time, so it’s important to factor this into your calculations.

- Housing Costs: Include mortgage payments or rent, property taxes, and home maintenance.

- Education Expenses: Project future tuition costs, school supplies, and other educational needs for your children.

- Healthcare Costs: Estimate ongoing medical expenses, health insurance premiums, and potential long-term care needs.

Accurate forecasting ensures your family has sufficient financial resources to cover future needs.

By thoroughly estimating your family’s anticipated costs, you can ensure they have enough financial support.

Step 4: Factor in Future Education Costs

If you have children, planning for their future education is a significant consideration. College tuition, books, and living expenses can add up quickly, making it essential to factor these costs into your life insurance calculation.

Securing funds for future education ensures your children have the opportunity to pursue their academic goals.

Estimate College Costs

Research current and projected college costs at universities your children might attend. Consider both public and private institutions, as tuition rates can vary significantly.

- 529 Plans: Explore using 529 plans to save for college. These plans offer tax advantages and can help you accumulate funds for future education expenses.

- Scholarships and Grants: While scholarships and grants can help reduce the financial burden, it’s wise to have a backup plan in case your children don’t receive sufficient financial aid.

Planning for education costs provides your children with a solid foundation for their future.

Preparing for education costs is vital for your children’s future opportunities and financial security.

Step 5: Account for Lost Income

Determine how much income your family would need to replace if you were no longer around. This involves calculating your current income and projecting future earnings.

Replacing lost income is a critical aspect of life insurance planning, ensuring your family maintains financial stability.

Consider Years Until Retirement

Estimate the number of years until you would have retired. This will help you calculate the total income your family would need to replace over the long term.

- Salary Replacement: Calculate your current salary and project how much your family would need to replace each year.

- Pension and Retirement Accounts: Factor in any pension benefits or retirement savings that your family would have access to.

By accurately accounting for lost income, you can provide your family with long-term financial security.

Replacing lost income is crucial for maintaining your family’s quality of life and financial stability.

Step 6: Consider Other Assets and Resources

Take into account any other assets or resources that your family could rely on, such as savings, investments, and existing life insurance policies. Subtracting these assets from your total needs can help you determine the remaining coverage required.

Balancing assets and resources is crucial to optimizing your life insurance coverage.

Savings and Investments

Evaluate your current savings accounts, investment portfolios, and other liquid assets that your family could access. This may include stocks, bonds, mutual funds, and real estate holdings.

Understanding your accessible financial assets ensures you’re neither over-insured nor under-insured.

By considering all available resources, you can tailor your life insurance coverage to meet your family’s specific needs.

| Key Aspect | Brief Description |

|---|---|

| 💰 Income Replacement | Calculates lost income for family’s financial stability. |

| 🎓 Education Costs | Estimates future tuition to secure children’s academic goals. |

| 🏡 Living Expenses | Projects housing, food, & healthcare to maintain living standards. |

| ⚱️ Funeral Costs | Coverage for funeral and burial expenses. |

Frequently Asked Questions

▼

You should reassess your life insurance needs annually or whenever you experience a significant life event, such as marriage, the birth of a child, a change in income, or a major purchase like a home.

▼

Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage and includes a cash value component that grows over time.

▼

Yes, you can have multiple life insurance policies. This can be useful for covering different needs or supplementing existing coverage as your financial circumstances change over time.

▼

Inflation erodes the purchasing power of money, so it’s essential to factor inflation into your calculations to ensure your life insurance coverage remains adequate over time.

▼

Generally, life insurance premiums are not tax-deductible. However, the death benefit paid to your beneficiaries is typically tax-free, providing a valuable financial benefit to your loved ones.

Conclusion

Determining the right amount of **life insurance: How Much Do You Need? A Step-by-Step Guide to Calculating Your Coverage** involves a comprehensive assessment of your financial situation, future needs, and available resources. By following these steps, you can ensure that your loved ones are financially protected in the event of your passing, providing peace of mind and security for their future.