Inflation Rate Soars to 4.9% – A New Economic Reality

New data reveals that the inflation rate has risen to 4.9%, marking the highest level in 18 months, signaling potential shifts in economic policies and affecting consumer spending habits across the United States.

The latest economic reports indicate a significant uptick in inflation, with the rate now standing at 4.9%. This marks the highest level seen in the past 18 months, raising concerns and sparking discussions among economists, policymakers, and consumers alike. Understanding the factors contributing to this surge is crucial for navigating the changing economic landscape.

Understanding the Inflation Surge: A Comprehensive Overview

The recent surge in the inflation rate to 4.9% has prompted a deep dive into the underlying causes and potential implications. This section aims to provide a comprehensive overview of the factors contributing to this increase, setting the stage for a more detailed analysis in the subsequent sections.

We will explore the immediate economic conditions, policy changes, and global events that have collectively influenced this inflationary trend. This includes a look at supply chain disruptions, increased consumer demand, and the effects of fiscal and monetary policies enacted in response to the COVID-19 pandemic.

Key Factors Driving Inflation

Several factors have been identified as primary drivers behind the recent inflation surge. These include:

- Increased Consumer Spending: As economies reopen, pent-up demand and government stimulus have fueled increased consumer spending.

- Supply Chain Disruptions: Global supply chains continue to face significant disruptions, leading to shortages and higher prices for goods.

- Labor Market Dynamics: Labor shortages in certain sectors have driven up wages, contributing to increased production costs and prices.

Understanding these key factors is essential for predicting future economic trends and developing effective strategies to mitigate the impact of inflation on businesses and households.

In conclusion, the interplay of increased demand, supply chain bottlenecks, and labor market shifts has created a challenging inflationary environment. The following sections will delve deeper into these drivers, providing a more granular understanding of the current economic situation.

Impact on Consumers: How 4.9% Inflation Affects Your Wallet

The rise in inflation to 4.9% directly impacts consumers across the United States, affecting their purchasing power and overall financial well-being. This section focuses on the specific ways in which increased inflation rates translate into tangible changes in the everyday lives of American households.

From higher prices at the grocery store to increased costs for essential services, we examine the immediate and potential long-term effects on consumer spending habits and financial planning. This analysis provides a clear picture of how inflation influences budget decisions and lifestyle adjustments.

Rising Costs of Essential Goods and Services

One of the most noticeable impacts of inflation is the increase in prices for essential goods and services. This includes:

- Groceries: The cost of food staples such as bread, milk, and eggs has risen significantly, impacting household budgets.

- Gasoline: Higher fuel prices affect transportation costs, making it more expensive to commute and travel.

- Housing: Both rental and homeownership costs are increasing, placing a strain on housing affordability.

Strategies for Consumers to Cope with Inflation

Given the impact of rising inflation, it’s crucial for consumers to adopt strategies to mitigate its effects. Consider the following:

- Budgeting and Expense Tracking: Understanding where your money goes can help identify areas for potential savings.

- Seeking Discounts and Deals: Taking advantage of sales, coupons, and loyalty programs can reduce expenses.

- Investing Wisely: Consider inflation-protected securities and other investments that can help maintain purchasing power.

In summary, the 4.9% inflation rate has a broad impact on consumers, necessitating careful financial planning and adaptive spending habits. By understanding the specific effects and employing strategic coping mechanisms, individuals can better navigate the challenges posed by increasing prices.

The Federal Reserve’s Response: Monetary Policy and Inflation Control

In response to the rising inflation rate, the Federal Reserve plays a crucial role in implementing monetary policies aimed at controlling inflation and stabilizing the economy. This section focuses on the actions taken by the Federal Reserve and their intended effects on inflation and economic growth.

We will explore the various tools at the Federal Reserve’s disposal, including interest rate adjustments, quantitative easing, and reserve requirements, and how these measures are employed to manage inflation. The effectiveness and potential consequences of these policies are also discussed.

Tools Used by the Federal Reserve

The Federal Reserve employs several key tools to manage inflation. These include:

- Interest Rate Adjustments: By raising or lowering interest rates, the Federal Reserve influences borrowing costs and economic activity.

- Quantitative Easing (QE): This involves the Federal Reserve purchasing assets to increase the money supply and lower long-term interest rates.

- Reserve Requirements: The Federal Reserve sets the percentage of deposits that banks must hold in reserve, influencing the amount of money available for lending.

These tools enable the Federal Reserve to influence economic conditions and achieve its dual mandate of price stability and maximum employment.

In conclusion, the Federal Reserve’s response to rising inflation involves a complex set of monetary policies designed to balance price stability with economic growth. Understanding these policies and their potential impact is crucial for businesses and consumers alike.

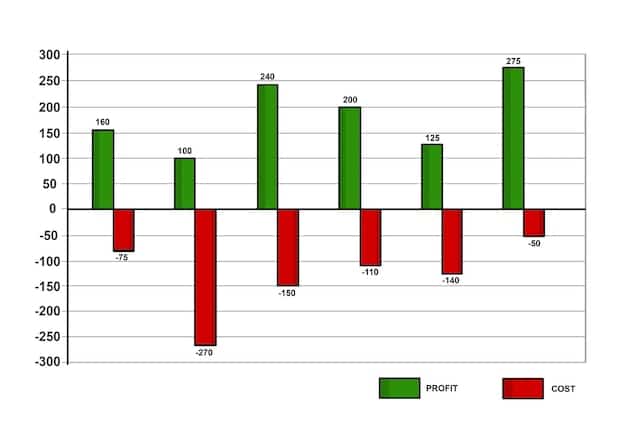

Industry Impacts: Winners and Losers in an Inflationary Environment

The 4.9% inflation rate creates a dynamic economic environment that affects various industries differently. This section delves into the specific impacts on key sectors, identifying potential winners and losers in the current inflationary climate.

We will analyze how industries such as technology, manufacturing, retail, and healthcare are navigating the challenges and opportunities presented by rising inflation. This includes examining how companies are adjusting their pricing strategies, managing supply chains, and adapting to changing consumer behavior.

Industries Poised to Benefit from Inflation

While many sectors face challenges due to rising inflation, some industries may experience a boost:

- Commodities: Companies involved in the production of essential commodities such as oil, gas, and metals often benefit from increased prices.

- Real Estate: Real estate can serve as a hedge against inflation, with property values and rental income potentially increasing.

- Discount Retailers: Retailers offering lower-priced goods may attract more customers as consumers seek to reduce spending.

Challenges Faced by Other Industries

Conversely, several industries face significant headwinds in an inflationary environment, including:

- Manufacturing: Increased costs for raw materials and components can squeeze profit margins and reduce competitiveness.

- Technology: Rising labor costs and supply chain disruptions can impact technology companies and delay product launches.

- Healthcare: Increased expenses for medical supplies and labor can strain healthcare providers and potentially raise patient costs.

In short, the 4.9% inflation rate creates winners and losers across different sectors, requiring businesses to adapt and innovate to remain competitive. The ability to manage costs, adjust pricing strategies, and respond to changing consumer preferences will be crucial for success in this inflationary environment.

Global Perspective: Comparing Inflation Rates Worldwide

Understanding the global context of inflation is crucial for assessing the economic challenges and opportunities facing the United States. This section provides a comparative analysis of inflation rates in various countries, offering insights into the factors driving these differences and the potential implications for international trade and investment.

We will examine the inflation rates in major economies such as Europe, Asia, and South America, identifying common trends and unique regional dynamics. This comparative perspective helps to contextualize the 4.9% inflation rate in the US and informs strategies for managing global economic risks.

Regional Inflation Trends

Inflation rates vary significantly across different regions of the world. Key observations include:

- Europe: Several European countries are experiencing similar or higher inflation rates due to energy price increases and supply chain disruptions.

- Asia: Inflation rates in Asia are generally lower than in the US and Europe, although some countries face specific inflationary pressures.

- South America: Many South American countries continue to grapple with high inflation rates, driven by currency depreciation and political instability.

These regional differences underscore the importance of tailored economic policies and global cooperation to address inflationary challenges effectively.

In conclusion, comparing inflation rates worldwide highlights the complex interplay of global economic forces and policy responses. By understanding these dynamics, businesses and policymakers can make more informed decisions and navigate the challenges of a global inflationary environment.

Predicting the Future: Economic Forecasts and Inflation Projections

Forecasting future economic trends is essential for businesses, investors, and policymakers to make informed decisions. This section focuses on economic forecasts and inflation projections, providing insights into the potential trajectory of the US economy and the likely path of inflation in the coming months and years.

We will examine expert opinions, economic models, and leading indicators to assess the range of possible outcomes and the key factors that could influence these projections. This analysis aims to provide a balanced perspective on the risks and opportunities facing the US economy.

Expert Opinions and Economic Models

Leading economists and financial institutions offer a range of perspectives on future inflation trends. Key insights include:

- Short-Term Projections: Many analysts expect inflation to remain elevated in the short term before gradually declining as supply chain issues ease.

- Long-Term Outlook: Long-term inflation projections vary, with some economists warning of persistent inflationary pressures and others predicting a return to more moderate levels.

Key Factors Influencing Inflation Projections

Several factors are critical for shaping future inflation trends:

- Federal Reserve Policy: The Federal Reserve’s monetary policy decisions will play a significant role in managing inflation expectations and economic growth.

- Global Economic Conditions: Global economic trends, including supply chain dynamics and international trade, will influence inflation in the US.

- Consumer Spending: The level of consumer spending and confidence will impact demand-driven inflationary pressures.

In summary, predicting the future of inflation involves a complex assessment of economic indicators, expert opinions, and key influencing factors. By staying informed and considering a range of potential outcomes, businesses and policymakers can better prepare for future challenges and opportunities.

| Key Point | Brief Description |

|---|---|

| 🔥 Inflation Rate | Increased to 4.9%, the highest in 18 months. |

| 🛒 Consumer Impact | Rising prices on groceries, gasoline, and housing. |

| 🏦 Fed’s Response | Using interest rates and QE to control inflation. |

| 📈 Industry Winners | Commodities, real estate, and discount retailers. |

Frequently Asked Questions

▼

The current inflation rate has risen to 4.9%, marking the highest level in the past 18 months in the United States.

▼

Inflation leads to higher prices for essential goods and services, reducing consumers’ purchasing power and affecting their budgets.

▼

The Federal Reserve is using monetary policy tools, such as adjusting interest rates and quantitative easing, to manage inflation.

▼

Commodities, real estate, and discount retailers often benefit from inflation, as prices and demand for their products may increase.

▼

Consumers can budget carefully, seek discounts, and consider inflation-protected investments to mitigate the impact of rising prices.

Conclusion

In conclusion, the recent rise in the inflation rate to 4.9% presents significant challenges and opportunities for consumers, businesses, and policymakers. Understanding the underlying causes, impacts, and potential responses to this inflationary trend is crucial for navigating the evolving economic landscape and making informed decisions.