Healthcare Subsidies Alert: Millions of Americans Affected by Changes

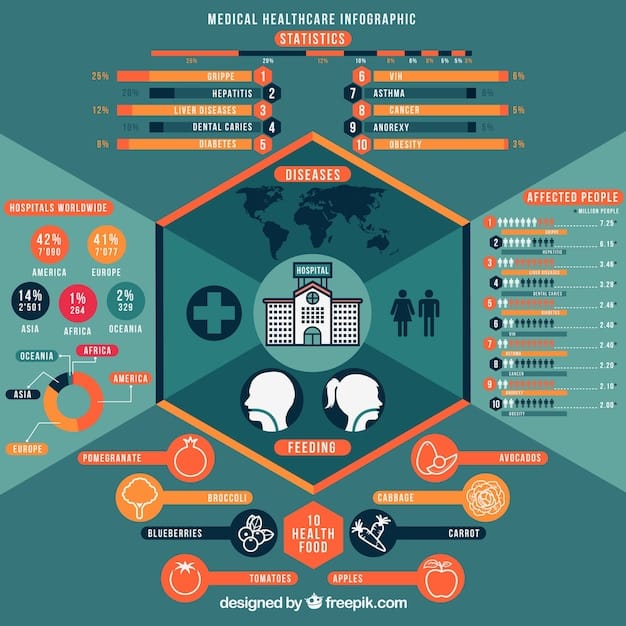

Millions of Americans are potentially affected by recent changes to healthcare subsidies, impacting access and affordability of health insurance coverage under the Affordable Care Act (ACA).

A significant alert: changes to healthcare subsidies announced, affecting millions of Americans. These modifications could alter the amount of financial assistance individuals and families receive to help pay for health insurance purchased through the Health Insurance Marketplace.

Understanding the Healthcare Subsidy Changes

Navigating the world of healthcare subsidies can be complex, especially when changes are announced. It’s crucial to understand the specifics of these updates to assess how they might affect your healthcare coverage and financial well-being. This section will break down the key aspects of the recent adjustments.

The recent changes to healthcare subsidies primarily impact eligibility criteria, income thresholds, and the calculation methods used to determine the amount of assistance individuals and families receive. These changes are multifaceted, and affect different income brackets.

Key Changes to Eligibility Criteria

One of the most significant aspects of the recent changes is the modification of eligibility criteria for healthcare subsidies. Previously, certain income limits applied, potentially disqualifying some individuals and families from receiving assistance. Also, some of the documentation requirements have changed.

Impact on Different Income Brackets

The effects of these subsidy changes vary depending on income level. Those with lower incomes may experience increased subsidies, while higher-income individuals could see a decrease in their level of financial assistance. The subsidy decrease depends on how high their income is.

- Increased subsidies for lower-income individuals.

- Adjusted income thresholds for subsidy eligibility.

- Modified calculation methods for determining assistance amounts.

- Potential decreases in subsidies for higher-income individuals.

In summary, understanding the eligibility criteria and impact on different income brackets is essential for predicting how the recent subsidy changes will influence your healthcare coverage and costs.

Who is Affected by These Healthcare Changes?

The changes to healthcare subsidies have a broad reach, affecting various demographics across the United States. Understanding who is most likely to be impacted can help you determine whether or not you need to make adjustments to your healthcare plan or budget. Therefore, determining vulnerability to these changes is key.

Several key demographics stand out as being particularly affected by these changes. Lower-income individuals, families with multiple dependents, and self-employed individuals are among those who may experience the most significant shifts in their healthcare subsidies as a result of the alterations.

Lower-Income Individuals and Families

Lower-income individuals and families often rely heavily on healthcare subsidies to afford coverage. As a result, changes in subsidy amounts or eligibility criteria can have a substantial impact on their access to healthcare services. Even a small change could lead to not being able to afford healthcare.

Self-Employed Individuals

Self-employed individuals, who typically purchase health insurance through the individual market, are also likely to be affected by these changes. Since their income can fluctuate, they are often susceptible to subsidy changes based on that reason.

- Lower-income individuals may see significant changes in their subsidy amounts.

- Families with multiple dependents could experience variations in their subsidy eligibility.

- Self-employed individuals might face adjustments in their financial assistance due to income fluctuations.

Overall, the impact of these changes extends across various demographics, highlighting the need for individuals and families to carefully review their healthcare coverage options and understand the implications of the subsidy alterations.

How to Determine Your New Subsidy Amount

Calculating your new subsidy amount requires a clear understanding of the updated income thresholds, eligibility criteria, and calculation methods. Gathering the necessary information and utilizing available resources will help you accurately estimate your financial assistance.

To effectively determine your new subsidy amount, start by gathering essential financial documents such as tax returns, pay stubs, and any other records that provide an accurate reflection of your household income.

Gathering Financial Documents

Having accurate financial documents on hand is critical for calculating your new subsidy amount. Tax returns, pay stubs, and other income records serve as the foundation for determining your eligibility and the level of financial assistance you are entitled to receive. Make sure all of these are readily available.

Using Online Calculators and Resources

Online calculators and resources provided by healthcare.gov and other reputable sources can help you estimate your subsidy amount based on your income, household size, and other relevant factors. These tools can simplify the calculation process and provide you with a clearer picture of your potential savings or costs.

- Gather tax returns and pay stubs to accurately reflect your income.

- Utilize online calculators provided by healthcare.gov and other sources.

- Review the updated income thresholds and eligibility criteria.

To determine your new subsidy amount, it will take the gathering of financial documents and the use of online calculators and resources.

Strategies for Managing Healthcare Costs Amid Changes

When faced with alterations in healthcare subsidies, it’s crucial to proactively manage your healthcare costs to ensure affordability and access to necessary services. Several effective strategies can help you navigate these changes and optimize your healthcare budget.

One of the primary ways to manage costs is to explore alternative coverage options that may be more affordable or better suited to your healthcare needs. These options include comparing different plans on the Health Insurance Marketplace and the plan benefits themselves.

Exploring Alternative Coverage Options

Taking the time to compare different health insurance plans available on the Health Insurance Marketplace can reveal opportunities to lower your monthly premiums or access better coverage at a more affordable price. This can often be done by simply changing the healthcare provider or slightly modifying the plan.

Adjusting Healthcare Spending Habits

Making conscious choices about your healthcare spending habits is another effective way to manage costs. This may involve opting for generic medications, utilizing in-network providers, and exploring preventative care services.

- Compare different health insurance plans on the Health Insurance Marketplace.

- Consider high-deductible health plans.

- Opt for generic medications to save on prescription costs.

- Utilize in-network providers to minimize out-of-pocket expenses.

To summarize, managing healthcare costs amid the subsidy changes involves comparing available plans, adjusting spending habits, and taking advantage of cost-saving strategies to ensure access to affordable coverage and care.

Seeking Professional Assistance and Guidance

Navigating the complexities of healthcare subsidies and insurance options can be overwhelming, especially in light of recent changes. Seeking professional assistance and guidance from knowledgeable resources can provide clarity, support, and personalized recommendations.

One of the most valuable resources for individuals and families is connecting with certified insurance brokers or navigators who specialize in assisting people with healthcare enrollment and subsidy applications. There are also agents that can do the same.

Connecting with Certified Insurance Brokers or Navigators

Certified insurance brokers and navigators possess in-depth knowledge of healthcare regulations, subsidy programs, and insurance plan options. They can assess your unique circumstances, explain the changes in subsidies, and guide you toward the best coverage solutions for your needs.

Utilizing Government Resources and Helplines

Government resources such as healthcare.gov and state-run healthcare exchanges offer a wealth of information, tools, and helplines to assist individuals and families with their healthcare-related questions and concerns. These resources can provide answers to common queries, clarify eligibility criteria, and guide you through the enrollment process.

- Connect with certified insurance brokers or navigators for personalized guidance.

- Utilize government resources such as healthcare.gov for information and support.

- Contact state-run healthcare exchanges for assistance with enrollment.

Seeking professional assistance from certified insurance brokers, utilizing government resources, and engaging with community organizations can empower you to navigate the subsidy changes with confidence.

Long-Term Implications of the Subsidy Adjustments

While the immediate impact of the healthcare subsidy adjustments is important to understand, it’s equally critical to consider the long-term implications of these changes. The subsidy changes could be a precursor to more changes incoming.

One of the primary long-term implications of the subsidy adjustments is the potential impact on healthcare affordability and access for individuals and families across the United States. This is especially true for those with lower incomes or those who rely on the financial help.

Impact on Healthcare Affordability and Access

Adjustments can affect the affordability of health insurance coverage. Reduced subsidies can make it more challenging for individuals and families to afford the premiums, deductibles, and out-of-pocket expenses associated with healthcare plans. Thus, they may be forced to go without healthcare.

Potential Effects on the Insurance Market

The subsidy adjustments could also have ripple effects on the broader health insurance market. Changes in subsidy levels may influence the number of individuals who enroll in health plans, potentially leading to shifts in the risk pool and premium rates.

- Reduced subsidies may decrease healthcare affordability and access.

- Changes in subsidy levels could influence enrollment rates in health plans.

- Subsidies effect people in a large amount of ways.

Acknowledging and preparing for these long-term implications are essential steps for individuals, families, and policymakers alike in ensuring access to quality, affordable healthcare for all Americans.

| Key Point | Brief Description |

|---|---|

| 💰 Subsidy Changes | Eligibility criteria, income thresholds, and calculation methods for healthcare assistance have been updated. |

| 👪 Affected Groups | Lower-income individuals, families with dependents, and self-employed individuals are most likely to be affected. |

| 🧮 Calculating Subsidies | Gather financial documents and use online calculators to determine the new subsidy amount. |

| 🛡️ Managing Costs | Explore alternative coverage options, adjust healthcare spending habits, and seek professional guidance to manage costs. |

Frequently Asked Questions (FAQ)

▼

The changes could alter the amount of financial assistance you receive to help pay for your health insurance premiums, potentially increasing or decreasing the amount depending on your income and household size.

▼

You can find reliable resources and calculators on healthcare.gov, as well as through certified insurance brokers or navigators who can provide personalized guidance and assistance.

▼

You can explore alternative coverage options, compare different plans on the Health Insurance Marketplace, opt for generic medications, and utilize in-network providers to minimize out-of-pocket expenses.

▼

Professional insurance brokers can help you navigate the complexities of healthcare subsidies and insurance options, providing personalized recommendations based on your unique needs and circumstances.

▼

The long-term implications include potential effects on healthcare affordability and access, as well as shifts in the risk pool and premium rates within the broader health insurance market.

Conclusion

In conclusion, staying informed about the recent changes to healthcare subsidies, understanding their potential impact on your specific situation, and proactively exploring strategies to manage your healthcare costs are essential steps. By leveraging available resources and seeking professional guidance, you can navigate these changes with confidence and ensure continued access to affordable, quality healthcare coverage.